Key Takeaways

- High-net-worth individuals (HNWIs) and international investors have a significant influence on luxury real estate demand.

- Economic conditions, including interest rates and stock market performance, impact buyer behavior in the high-end market.

- Limited inventory and the desire for unique, customized properties drive competition and price appreciation.

- Technological advancements and sustainability features are increasingly significant to luxury homebuyers.

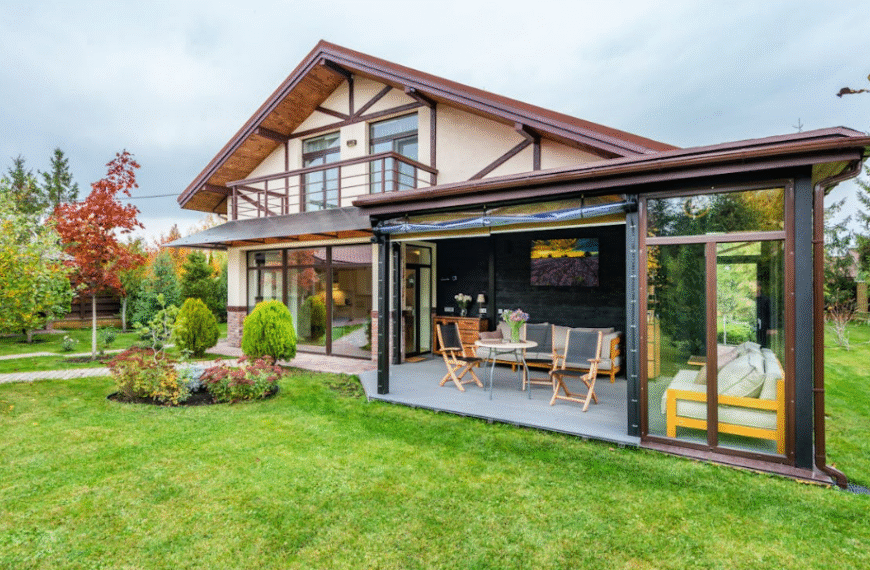

In today’s dynamic real estate landscape, certain factors consistently shape the appetite for upscale properties. Wealth accumulation, lifestyle preferences, and evolving work patterns often converge to influence purchasing decisions in high-end neighborhoods. Buyers are increasingly seeking homes that offer not only comfort but also exclusivity, advanced amenities, and investment potential. Economic stability and low-interest rates further amplify demand, making luxury properties attractive to both long-term residents and investors looking for value preservation.

Geographic appeal and unique property features also play a pivotal role in attracting discerning buyers. Areas offering cultural amenities, recreational opportunities, and privacy often see heightened interest. For instance, the market for Las Vegas custom luxury homes for sale illustrates how tailored architectural designs and location-specific perks can drive buyer engagement. Understanding these underlying motivators helps clarify why certain luxury real estate markets continue to flourish despite broader economic fluctuations.

Influence of High-Net-Worth Individuals and International Investors

High-net-worth individuals (HNWIs) are the cornerstone of luxury real estate markets. With the financial flexibility to purchase trophy properties outright or make substantial down payments, HNWIs treat high-end real estate as both a lifestyle statement and a hedge against volatility in other investment classes. Cities such as New York, London, and Hong Kong remain perennial favorites, attracting global buyers seeking status, security, and access to world-class amenities.

International investors further bolster demand, particularly in markets noted for their political stability, robust legal frameworks, and transparency. These buyers often diversify assets by acquiring premier properties abroad, helping to cement the prestige and liquidity of select urban markets.

Economic Conditions and Market Dynamics

Key economic indicators, such as interest rates and stock market performance, play a pivotal role in shaping demand for luxury homes. Unlike median or entry-level markets, the upper echelons of real estate are somewhat insulated from financing constraints, given that many luxury purchases occur as all-cash transactions. In 2025, more than half of luxury market specialists reported a marked uptick in cash deals, a trend reflecting the relative immunity of this segment to rising mortgage rates and inflationary pressures.

As economic uncertainty ebbs and flows, luxury property remains a favored haven for the world’s wealthy, especially when equity markets appear volatile.

Limited Inventory and Customization Trends

Scarcity shapes the competitive landscape of luxury real estate. The limited production of ultra-high-end properties—owing to zoning laws, geographical constraints, and strict building codes—means buyers often face fierce competition. Demand for homes that blend uniqueness, location, and privacy stimulates upward price movements.

Customization has risen to the forefront of luxury buyer preferences. Features such as private spas, state-of-the-art wellness amenities, home theaters, and expansive smart home systems are not only desirable but also expected. Residences are increasingly built or renovated to accommodate energy-efficient materials, bespoke interior design, and advanced technology systems that reflect owners’ personal tastes and priorities.

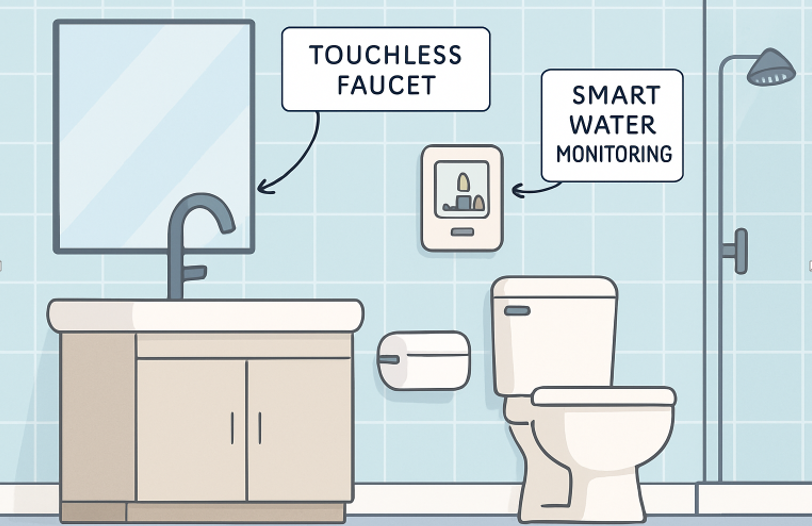

Technological Advancements and Sustainability

Technology is an integral part of a modern luxury home. Today’s buyers expect AI-based home automation, integrated security solutions, and seamless connectivity between smart devices. Sustainability, too, has shifted from a niche concern to a standard feature. High-profile buyers prioritize solar installations, technologies that maximize energy efficiency, and eco-conscious materials—not only to reduce their environmental footprint but also to future-proof their investments against forthcoming regulatory changes and evolving buyer expectations.

Innovations in these areas not only elevate the living experience but also add lasting value, making properties more attractive in both the present and future marketplace.

Global Market Trends and Regional Variations

Luxury real estate is deeply influenced by broader economic and political trends, with pronounced regional variations in growth and buyer preferences. For example, in 2024, Manila recorded a 26% increase in luxury property prices—the highest worldwide—while hotspots such as Dubai and the Bahamas posted 15% gains each. By contrast, mature markets like New York and London saw modest declines, a reminder that local factors and global shifts create distinct cycles within the global luxury sector.

Cultural preferences, investment-driven motivations, and migration patterns also play significant roles in shaping which markets lead or lag during different economic cycles.

Impact of Lifestyle and Wellness Amenities

Wellness and lifestyle-driven designs are now foundational to luxury homes. Buyers increasingly seek features such as spa-quality bathrooms, private gyms, resort-style pools, and expansive terraces for entertaining. The integration of biophilic design—bringing natural light, greenery, and outdoor connections into living areas—creates restorative environments that appeal to a health-conscious clientele.

As luxury homes become sanctuaries for both everyday living and wellness, developers and designers must stay ahead of trends to satisfy evolving buyer expectations, blending cutting-edge amenities with timeless comfort and exclusivity.

Conclusion

High-end real estate demand is shaped by the assets and ambitions of affluent buyers, evolving economic circumstances, and an integrated approach to technology and lifestyle. To navigate and succeed in this competitive sector, stakeholders must monitor not just broad economic trends but also granular shifts in buyer expectations, customization requirements, and sustainable living initiatives. The interconnectedness of these factors will continue to define the future of luxury property around the globe.