Key Takeaways

- Cash home buyers are significantly affecting supply, demand, and pricing in today’s real estate market.

- High-net-worth individuals and investors are the primary drivers, with certain regions experiencing a significant increase in all-cash purchases.

- The trend presents challenges for mortgage-dependent buyers and has prompted increased regulatory scrutiny.

- Future market dynamics will depend on mortgage rate trends and further policy changes.

Table of Contents

- The Rise of Cash Transactions

- Who Are the Cash Buyers?

- Impact on Home Prices

- Regional Variations

- Challenges for Mortgage-Dependent Buyers

- Regulatory Responses

- Future Outlook

The Rise of Cash Transactions

The current real estate market is seeing a significant rise in all-cash home purchases, with cash buyers now involved in nearly one-third of transactions nationwide. In the wake of pandemic-related uncertainties, this trend has remained well above pre-pandemic levels, offering faster closings and increased confidence for sellers. Homeowners looking to avoid lengthy closing processes or financing complications are increasingly attracted to cash offers. For those seeking a quick and hassle-free sale, resources like https://www.eazyhousesale.com/sell-my-house-fast-in-lynwood/ provide practical solutions to sell their houses efficiently and with minimal stress.

This pattern extends well beyond luxury properties, influencing both starter homes and mid-market listings. In today’s competitive landscape, cash sales offer a clear advantage, particularly for buyers seeking to stand out in bidding wars or negotiate more favorable contract terms.

The reasons behind the increase in cash transactions are multifaceted. High mortgage rates, coupled with stricter lending standards and persistent demand, have made traditional financing less attractive or even unaffordable for some. Analysts report that, in early 2025, approximately 32.8% of all home sales were cash deals, up from 28.6% just a few years prior. This shifting dynamic is not just a blip; it’s reshaping how buyers, sellers, and real estate professionals approach the marketplace.

For buyers, the shift to cash deals can offer a strategic advantage, enabling them to bypass contingencies and stand out in crowded markets. On the other hand, sellers who need to liquidate their properties quickly can benefit from connecting with a vast pool of cash buyers, as available through platforms like https://www.eazyhousesale.com/.

Who Are the Cash Buyers?

Cash buyers span a wide demographic, but notable groups include high-net-worth individuals, real estate investors, and those purchasing second homes. Affluent individuals who want to avoid mortgage origination costs, especially during a period of fluctuating interest rates, often rely on cash to expedite their purchases. Investors, particularly those interested in rental properties or home flipping, are increasingly favoring cash deals due to their simplicity and lower risk of transaction failure.

Recently, more retirees and downsizers have also joined this group, leveraging proceeds from previous home sales to buy their next residence outright. According to a recent analysis by Bloomberg, these segments of buyers are less affected by rising rates and banking restrictions, instead focusing on speed, certainty, and long-term investment horizons.

Impact on Home Prices

The influx of cash buyers has a pronounced impact on property values—especially in hot markets. Sellers receiving multiple offers often favor cash for its reliability and prompt closing. As a result, bidding wars are more common, with cash buyers able to push price points upward, sometimes well above the initial listing price. This dynamic puts additional pressure on those who rely on mortgages, who must either increase their offers or risk losing out on competitive properties.

Effects on First-Time and Average Buyers

For many average homebuyers, particularly first-time buyers, the prevalence of cash offers is making homeownership increasingly out of reach. This trend is particularly pronounced in urban and coastal markets, where investor activity is highest, and demand continues to outstrip supply. Neighborhoods once considered affordable are now experiencing rapid appreciation rates, partly due to the agility of cash buyers.

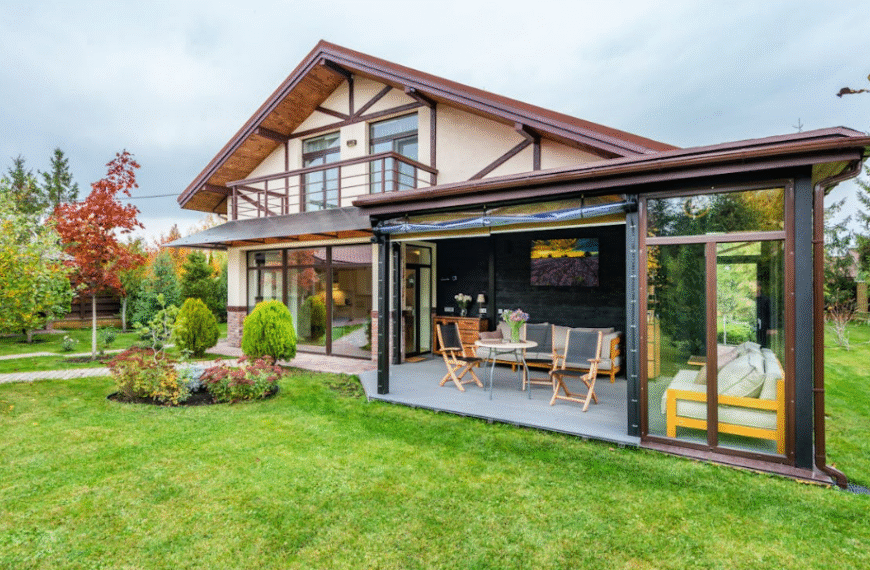

Regional Variations

The impact of cash buyers isn’t uniform across the United States. States such as Florida, Georgia, and Mississippi report significantly higher percentages of all-cash sales compared to the national average. For example, West Palm Beach, Florida, recently saw almost 49% of home purchases completed without financing.

This concentration is partly due to the popularity of these locations among retirees, investors, and out-of-state buyers seeking second homes. According to CNBC, the pattern reflects both local economic strength and outside investment, further pushing prices upward while tightening inventory.

Challenges for Mortgage-Dependent Buyers

Buyers who rely on financing face significant hurdles in markets where cash offers are prevalent. Not only do they contend with lenders’ strict qualifications and slow approval processes, but they must also battle against the perception that mortgage funding introduces more risk. As a result, buyers with lower down payments or those relying on government-backed loans are at a particular disadvantage, forcing many to expand their search areas or delay their homeownership goals.

This dynamic is exacerbating wider affordability and access issues, particularly for those trying to enter the market for the first time. The phenomenon of bidding above listing prices to remain competitive with cash buyers can lead to unsustainable debt loads and impact long-term financial stability for these individuals.

Regulatory Responses

With all-cash deals on the rise, regulators are intensifying their efforts to ensure transparency and prevent the misuse of real estate purchases for money laundering or other illicit activities. The U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) now mandates the reporting of all-cash residential property transactions made by legal entities and trusts. These initiatives are crucial in tracking high-value sales and maintaining the integrity of real estate markets, especially in areas prone to large-scale investment or international buying activity.

Future Outlook

The strong presence of cash home buyers is likely to persist in the coming years, regardless of small fluctuations in mortgage rates or periodic shifts in economic sentiment. While falling interest rates could rebalance the market by making financing more accessible, few experts predict a drastic decline in cash sales unless rates return to historically low levels. Buyers, sellers, and industry professionals should continue to adapt by staying informed about evolving trends and new regulations as the market continues to transform.

For continued updates and in-depth analysis, readers can consult leading resources, such as FortuneBuilders and The New York Times’ Real Estate section, which regularly cover shifts in housing demand, policy, and investment patterns.