Establishing a solid legal framework is essential for building and maintaining family trust. A trusted family notary plays a key role in guiding families through legal planning steps such as wills, estates, and property agreements. With expert legal advice, families can prevent misunderstandings, ensure legacy preservation, and protect future generations. Legal planning fosters transparency and peace of mind, cornerstones of lasting family trust. Discover how a family notary can support your family’s unique legal journey.

The Importance of Legal Planning in Family Trust

A structured legal approach strengthens long-term family security and unity. Engaging a family notary ensures proper legal documentation and impartial guidance through critical decisions. This fosters trust among relatives. Legal planning outlines clear procedures, reducing potential conflicts related to inheritance or guardianship. Clarity in roles and responsibilities avoids emotional turmoil during difficult times. Trust grows when everyone feels legally protected and considered. Families thrive with transparency, consistency, and professional legal support guiding future decisions.

Structuring a Valid Family Trust

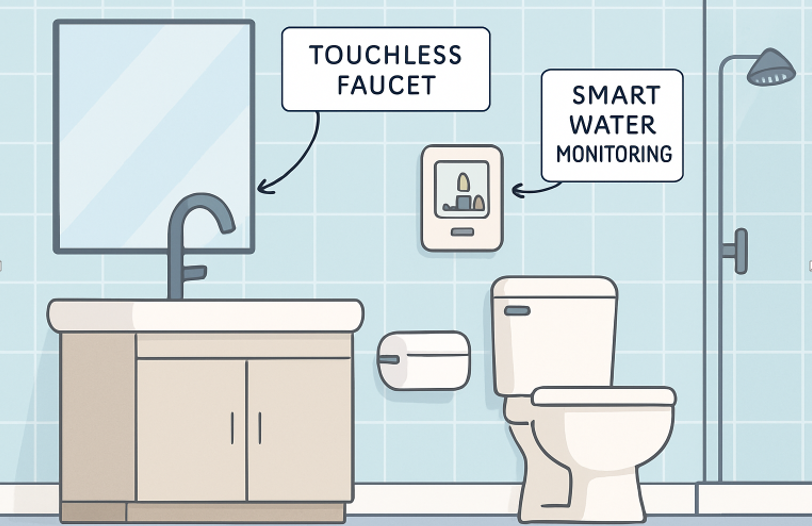

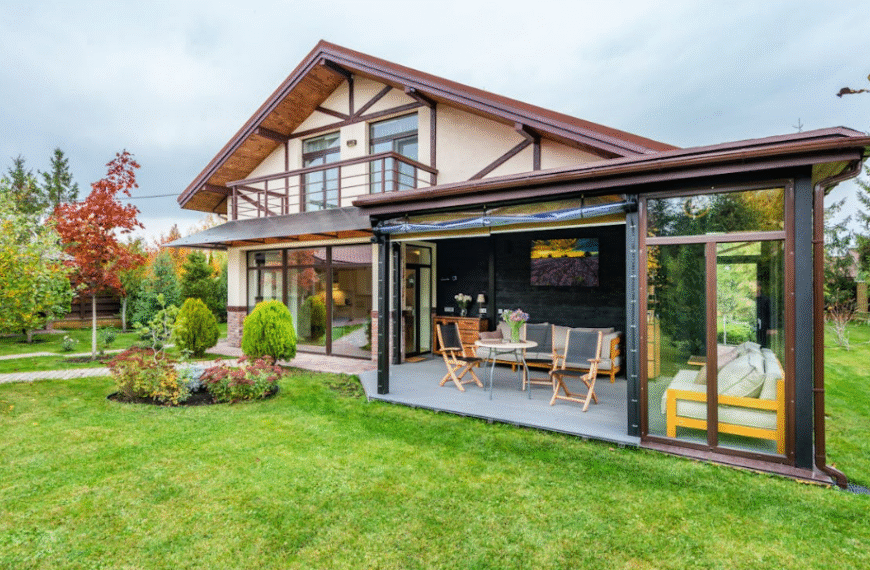

A valid family trust requires precise documentation and clear designation of responsible parties. Appropriate trust structures meet your family’s specific legal and financial goals. Accurate asset listing ensures intentions are legally honored. Trusts may include real estate, investments, and valuable personal properties. Legal specialists help tailor each detail to comply with state regulations. This legal backing creates confidence. Having official terms protects against misuse and ensures accountability among all involved individuals.

Designating Trustees and Beneficiaries

Selecting trustees reflects family values and ensures competent stewardship. Trustees must understand their roles and execute duties faithfully. Beneficiaries should be clearly identified to avoid misinterpretations. This clarity prevents disputes. Legal advisors ensure chosen individuals or institutions meet legal criteria. Transparent communication among trustees and beneficiaries builds trust and avoids future grievances. Establishing these roles early in the trust process supports smoother transitions during unexpected events. A well-outlined plan guarantees each voice is respected.

Encouraging Open Family Dialogue Through Legal Planning

Engaging in estate planning prompts honest discussions about expectations and wishes. Legal planning creates an environment of openness where all family members feel heard. This prevents resentment or confusion later. With legally defined roles and responsibilities, misunderstandings diminish. Professionals guide families toward empathetic conversations, allowing everyone to express concerns and preferences. Regular updates to legal documents reflect evolving dynamics. Transparency is key in maintaining mutual respect and harmony within the household structure.

Updating Legal Documents as Families Evolve

Family situations change due to marriages, births, divorces, or deaths. Legal documents must reflect those realities. Consistent reviews help keep trusts and agreements accurate. This ensures current laws and intentions remain aligned. When documents are outdated, legal disputes or unintended consequences may arise. Including periodic legal assessments as part of long-term planning reassures every member that their interests are preserved. Staying current builds confidence and solidifies a dependable family legal foundation.

See also: Affordable House Renovations That Transform Your Home Beautifully

The Role of Professional Legal Advisors

Expert legal advisors interpret laws and personalize plans for each family situation. Their neutrality encourages fair decision-making, especially during emotional times. These advisors foresee complications and offer tailored solutions. They facilitate risk management, tax coordination, and compliance with evolving regulations. Families depend on their expertise to avoid costly mistakes. By including professional guidance, the trust-building process becomes smoother and more effective. Strong family foundations often begin with experienced legal assistance focused on clear, enforceable arrangements.