Embarking on the journey to buy your first home can be one of life’s most rewarding, yet daunting, adventures. With economic factors pushing the median age of first-time homebuyers to an all-time high of 40 and affordability at the forefront of concerns, it’s never been more critical to have a well-crafted plan. Gaining a clear understanding of the steps involved and the unique market challenges puts you on a path to a successful, confident purchase. Nashville,TN real estate experts Onward Real Estate can guide you through each phase of your homebuying journey, especially in today’s complex housing market.

The process doesn’t need to feel overwhelming. By evaluating your financial readiness, learning about available programs, and understanding how to make a competitive offer, you can set realistic goals and avoid common pitfalls. Strategic decision-making, professional guidance, and careful preparation form the backbone of thriving as a first-time homebuyer.

Preparation begins with knowing where you stand and what the market looks like now. With fewer first-time buyers entering the market than ever before, arming yourself with information is the key to unlocking new opportunities. As you work through your homebuying checklist, remember that support is available through both local experts and national resources.

From budgeting and financing to closing and moving in, each step can be managed with patience and due diligence.

Understanding the Current Housing Market

The current housing market has seen significant changes, including rising home prices, mortgage rates above 6%, and a shortage of starter homes. As a result, the percentage of first-time home buyers is only 21%, the lowest since 1981. These dynamics underscore the importance of timing and flexibility in your search. You can make data-driven decisions rather than purely emotional ones by staying abreast of local and national industry trends. Market updates are often available from sources like The New York Times’ Real Estate section, which can help you develop a strategy and set reasonable expectations.

Assessing Your Financial Readiness

Your finances are the foundation of a successful home purchase. Start with a clear-eyed review:

- Credit Score: Lenders view higher credit scores favorably, often offering more competitive mortgage rates.

- Debt-to-Income (DTI) Ratio: Aim for a DTI of 43% or less. This is crucial to ensure you don’t overextend yourself financially.

- Savings: While 20% down is ideal to avoid PMI, many programs allow less; however, additional savings for closing costs, appraisal fees, and unexpected expenses are important.

Draft your homeownership budget with a detailed approach, including estimated monthly payments, anticipated repair bills, and association fees. This gives you a clear view of what you can truly afford, helping you avoid unpleasant surprises.

See also: Elevating Estates: Luxury Property Management Services in Florida

Exploring Financing Options

First-time buyers should understand the range of lending products available. Fixed-rate mortgages are often preferred for their predictability, but adjustable-rate mortgages may offer lower introductory rates, which can be advantageous in the short term. Carefully weigh the trade-offs with a trusted mortgage advisor. Evaluate whether a conventional, FHA, VA, or USDA loan best matches your financial profile and plans. Each option has unique benefits and requirements.

Leveraging First-Time Homebuyer Programs

State, local, and federal programs can be a game-changer. Down payment assistance, tax credits, and grants are often available to first-time buyers, helping significantly reduce the financial barriers to entry. In Tennessee, for example, local housing authorities and nonprofits may offer support tailored to income levels or targeted neighborhoods. Be diligent in researching eligibility criteria and applying early, as funding can be limited.

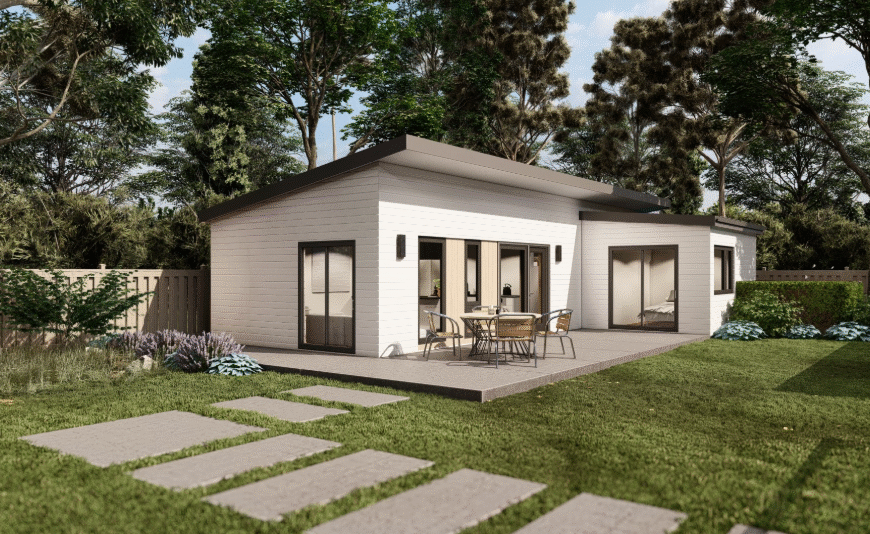

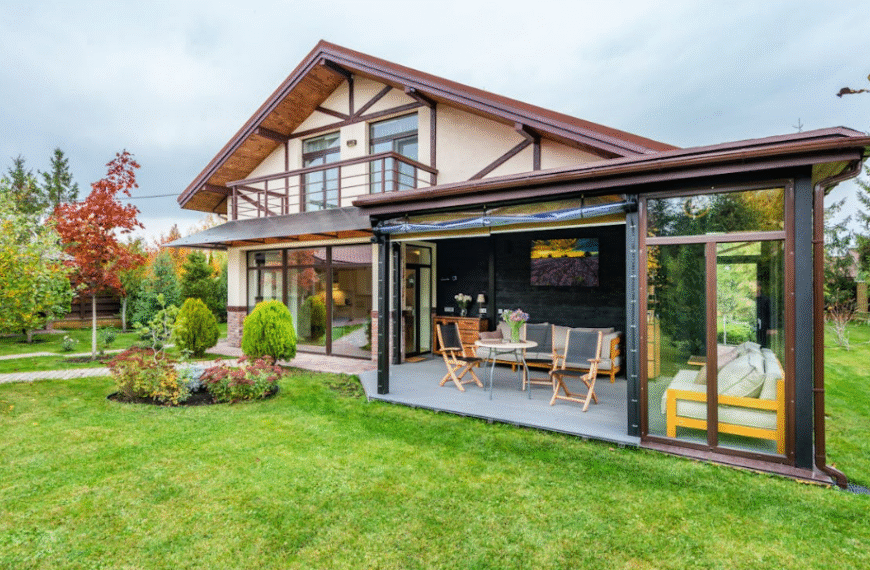

Choosing the Right Location

Where you buy is just as important as what you buy. Consider commute times, proximity to schools, shopping options, recreational areas, and long-term neighborhood outlooks. Evaluating crime rates and local school rankings through publicly available data sources is prudent. Sometimes, up-and-coming neighborhoods offer the best compromises between price and future appreciation potential. Weigh your choices with both current lifestyle and resale prospects in mind.

Working with Real Estate Professionals

The right experts make all the difference. An experienced real estate agent brings neighborhood expertise, market insight, and negotiation skills to your transaction. Mortgage brokers can help demystify loan products and secure favorable terms. Look for professionals with solid reputations, referrals, and a willingness to educate along the way. Transparent communication keeps you prepared for each step.

Making a Competitive Offer

Today’sToday’s requires buyers to move quickly and strategically. When you’ve the right home:

- Get pre-approved for a mortgage to demonstrate your seriousness to sellers.

- Accommodate the seller’s red timeline when possible, while remaining flexible on closing or possession dates.

- Limit contingencies while maintaining essential protections, such as a home inspection and financing.

While it’s important to stay competitive, never bid beyond your comfort zone. Setting a ceiling and sticking to it will prevent regret down the line.

Preparing for Closing

After your offer is accepted, the finish line is in sight. Conduct a thorough home inspection to identify potential deal-breakers early. Stay organized by keeping all documents readily accessible and responding promptly to requests from your lender or closing attorney. Don’t forget to line up homeowners’ once and budget for closing costs. The final walkthrough is your chance to confirm the home’s condition never skip it.

With careful planning, resourcefulness, and the right help, you can navigate even the most challenging market. Understanding current trends, preparing your finances, and leveraging available resources will help you make decisions that support both your immediate needs and long-term goals.

Conclusion

Becoming a first-time homeowner in today’s market may feel challenging, but it is entirely achievable with the right preparation and mindset. By understanding current housing conditions, strengthening your financial foundation, and taking advantage of available assistance programs, you position yourself to make informed and confident decisions. Each step from selecting the right location to crafting a competitive offer builds toward a purchase that supports both your lifestyle and long-term financial health.

Thriving as a first-time buyer is not about rushing into a decision, but about approaching the process with clarity, patience, and trusted guidance. With knowledgeable professionals by your side and a clear strategy in place, you can navigate market hurdles and turn what feels like a daunting milestone into a rewarding achievement. Your first home is more than a purchase; it’s the foundation for your next chapter, and with careful planning, it can be one you enter with confidence and peace of mind.